fully support this proposal, infact I think 10% inflation is also too high but 10% is still better than 20%

what about the min limit ?

I agree wiht this proposal, ATOM as a center of AEZ needs to be more like reserve currency, inflation ideally from my point of view must be between 3 to 1%, anually, inflation at 20% is like inflation in 3rd world countries, DeFi can’t flourish if simple staking is better than any yield you could get adding layers of complexity, ATOM must define its primacy an be a reserve of value desirable to buy because it is the entry point to this ecosystem. 10% At least for now sounds good for me as starting point economics must adjust by offer and demand, flush out weak hands and speculators is a good thing to the project.

Hypothetically if the price reacts to the supply of the newly minted tokens linearly there shouldn’t be any problem, BBB bought 100 Atom at 10 USD for 1K USD and with 20%APY over the two years BOB has now 144 ATOM, and even if the price of Atom is 7 USD I have more number of tokens but that is equal to my BOB’s original 1000 USD. Now we have established in the example mathematically that if price reacts to inflation linearly nobody gets hurt. But, this doesn’t happen, It also depends on the market’s external forces, liquidity, and utility. Only the utility adds to the value of the token intrinsically not artificially, reducing the inflation by 50% at this point in time will not only hurt the existing investors who have already lost a lot in the bear market Considering ATOM ATH was 44 USD on Jan 2022. But also it is a haphazard step that has not been proven right in the past either.

Another argument to not support this idea is the examples of JUNO, OSMO, Stargaze, and many more who have reduced the inflation greatly but that affected the price of said tokens negatively. Yes, there might be external factors contributing to the price drop of these tokens but no one can prove it mathematically. What we have seen in the past is the price was dropping and they decided to reduce the inflation but it didn’t work not a single example.

Additionally, Why do we want to support the LSM in the current stage, where we are making a king (Stride) and they only add to centralization by delegating to 32 validators only? And we see most of these 32 validators again and again as beneficiaries of the system. Maybe this is just a coincidence that these validators get all the major delegations from ICF and Stride. Whether it is a coincidence or not but we should all agree that Stride being a LSD leader should not have the technical capability to decentralize the stake as we have imagined other LSD providers pStake and Quicksilver although they have better decentralization policy where pStake stakes with 75+ validtaors and quicksilver Stakes with the entire set, are not ready for mass adoption. We need to let it cool down for a bit and improvise on the basis of the reasonable data set. So LSM is not at all a motivation for me.

Lastly, the validators, reduce the inflation by 50% meaning the income of the validator will reduce by 50% now it does not matter for 50% of the top validators but for the bottom 50% it matters, given the ICS and all the consumers chains giving no revenue at all. A validator needs 300K in delegations at 5% commission to make 800USD (A monthly cost some believe is the average cost of running a node).

The relationship between inflation, token value, and the practical implications for validators and investors is far from straightforward, and reducing inflation might not be the panacea it initially seems.

I agree STRD is a ticking bomb.

I see ups and downs to this really, due to the fact that we’d increase overall leverage. But building out defi would be good.

This is why I am overall supportive. If we don’t like it it could be changed back.

Unsure about this.

The whole point of $ATOM is that it is owned and operated by stakers.

Without 2/3 staked there is NO IBC SECURITY in the face of HOSTILE TAKEOVERS.

If $ATOM IBC isn’t secure, it has NO UTILITY OR PURPOSE.

(actually scratch that, the only purpose is for rugging)

The inflation is a punishment for not doing your job as an ATOM holder.

You should be staking. If you aren’t staking, you don’t deserve to hold $ATOMs.

Everyone who doesn’t grok this should just sell their atoms and leave,

or stop complaining when the hub does fork to leave the herd behind.

Nobody should be participating in a IBC hub that can’t understand systemic risk.

Cosmos and Tendermint were created as a secure alternative to the

status quo global elitist psychopathic banking dynastic criminal syndicates.

What’s the point if we just make the same bullshit as the last generation?

Either build upon first principles and do not budge in the face of profits,

or don’t try to build financial infrastructure that sells security.

If you don’t take seriously and sell security,

you will have blood on your hands.

It’s fine to remove the minimum bound of the inflation rate.

With ICS and the earning of tx fees,

the inflation rate will naturally decrease and even go negative.

I think min inflation should also change and put to 0%

Let’s remove the lower inflation bound, and let it even go negative.

(but this needs to be tested). But leave the max alone.

Let this be a mantra for the hub.

“ATOM is not a monetary token. Stake or GTFO”

Literally, the more we repeat the mantra,

the more secure and awesome the hub will get.

I see this argument also.

What do you say to the claim that the adjustment rate is too slow?

Also let’s tally:

- icformulet: let’s publish everything and leave it waving in public (they’re irrelevant and risky and should be froze imo)

Jae: Keep the staked ATOMs at 2/3 or you’re just rugging people, so DO NOT DECREASE THE MAX 20%. ALSO, REMOVE THE LOWER BOUND. - Zaki: 10% max inflation helps us mature def in cosmos (@zaki_iqlusion you want to keep the lower bound where it is?)

- Wickex: let’s remove the lower bound

I don’t think anyone is exactly wrong here.

what if we lower the lower bound to 5% and raise the upper bound to 25% and make the system more reactive so that the hub craves stake?

But with global interest rates where they are, 7 could frankly be appropriate

I find the whole conversation very interesting and wish to urge that we ensure staking is always above US interest rates.

There is some kind of weird palpable tension there.

Jae: Keep the staked ATOMs at 2/3 or you’re just rugging people, so DO NOT DECREASE THE MAX 20%. ALSO, REMOVE THE LOWER BOUND.

Jacob, you’re misrepresenting what I wrote 100%. Surprise surprise.

Strongly against this proposal for several reasons:

-EffortCapital is already proposing and discussing a similar idea, so why are you trying to rush things with this separated proposal now?

-Excuse me but this doesn’t only affect stakers, it affects ALSO validators, especially the smaller ones which are buried already in CCs costs. While EffortCapital and others are suggesting ideas to improve this such as the VP tax, you just suggest to bury small validators further?

-The 50% individual validator cap was never mentioned or discussed in the signalling proposal about the LSM, you quietly introduced this parameter. It is very telling that iqlusion is the only large validator voting no in the proposal to disable this parameter

-The minimum 5% fee proposal passed so this would already decrease the overall APR for stakers and moreover the proposed VP tax would also decrease the overall APR. The 5% minimum fee would already lead stakers to the LSM for higher yields

-All new consumer chain costs are covered by validators not stakers, you decrease inflation to penalize stakers, but you also affect negatively small validators running consumer chains!

-What do you have against small validators Zaki seriously? Let’s look at iqlusion, around 97% uptime in the last 3 months, around 50% overall governance participation, with 10% commission and almost in top 30 by VP you could have the resources to improve uptime, governance and perform upgrades faster?

-Inflation transfers wealth from those NOT staking ATOM to those staking. If you reduce inflation what you do is benefit those not staking. You think stakers are overpaid? Then small validators are UNDERPAID. The solution is ideas like the VP tax which puts a tax in stakers of the largest validators to fix 2 problems: reduce centralization, allow small validator to cover costs for multiple consumer chains

-It is not so simple as reduce inflation=price increase, look at what happened with Osmosis and others after large inflation reductions. The situation currently is very very tough with such low ATOM price and APR low as well compared to earlier this year, and what do you suggest? You don’t even think about small validators in your equation, you just suggest to cut inflation to 10% because according to you ‘stakers are overpaid’, but by doing this remember you not only affect stakers but small validators also!

I did not specify a time period for the scenario outlined, I rather spoke about the future, but thank you for the numbers this year. But what makes you optimistic that the outcome would have been better if the inflation parameter had been changed, before? In this proposal, the price is not even expected to compensate for the lower dilution let alone exceed it: “This will impact the rate of growth of the community pool and a separate proposal to increase the community pool take should be considered.”

edited. Surprise surprise. Wen federal lawsuit? surprise surprise

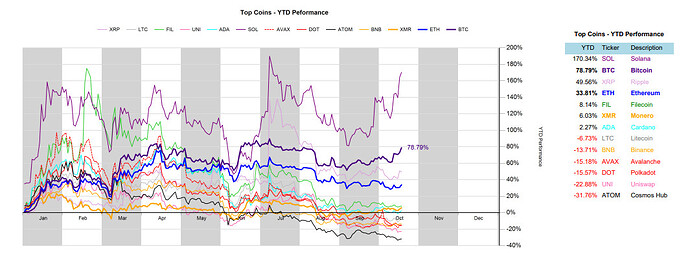

Here is a list of major L1 crypto assets I track (and a couple of DeFi tokens). On this list the token with the highest inflation is ATOM and that also happens to be the worst performer YTD from this group.

I don’t need to be sure about what the problem is. I know there is a problem and high inflation is one of them. That is one problem to fix and there seems to be an easy fix and we can start there. If that doesn’t work, we’ll think again.

If your answer is “create more utility for ATOM”, then that is easier said than done. Creating “utility” requires “investment” and is essentially a bet that some project will have product-market fit. We already tried to create utility for ATOM this year - interchain security. If ICS didn’t give utility to ATOM, then we shouldn’t be degenerate gamblers and spend more money on our next crazy idea.

I think the next move is cut the inflation and see how that works before we embark on our next pie-in-the-sky idea.

20% inflation has NOT guaranteed 2/3 staked. That is why inflation remains 20%, people are not staking the token. Not sure why you think 20% inflation guarantees 2/3 staked despite clear cut evidence to the contrary. This is a theory you had that is failing in practice.

No one wants to stake a token that is rapidly losing value. For people to want to stake the token it needs to have stable value first and 20% inflation is not generating stable value for the token. Thus the optimal inflation percentage that guarantees the combination of stable value and 2/3 staked is probably some number lower than 20%.

Right now, you are trying to do the same thing expecting a different result.

I am perfectly fine selling my ATOMs to you for the price I paid for them (average around $12) + 5% in interest I would have gotten in Treasuries for 1 year and then you can go and stake them yourself since you understand the tokenomics design better. It is pretty obvious here that your weren’t trying to create a decentralized token or one that has positive value. Also for what reason did you allow ATOM to be listed on all these exchanges like Coinbase, Binance, etc and did you make clear to the exchanges that the expected future value of ATOM is zero?

The inflation rate is literally 14% and 67% are bonded as we speak.

Jesus Christ.

Why isn’t the staking reward percentage decreasing then?

It’s supposed to reach an equilibrium.

If it decreased then the staking % would go down.

It’s literally working perfectly.

Hard to follow advices of someone who says ‘liquid ETH is about 7% of ETH’, this is incorrect because rather than 7% is around 36% of staked ETH, you need to talk about staked ETH since the 25% global cap of the LSM refers to staked ATOM: Introducing the Dynamic Liquid Staking Tax (Blockworks Research) - Cosmos Hub Fiscal Policy Part 1 - #17 by Cosmic_Validator