Update: The tokenomics RFP is live now for review. See the full RFP here: Request for Proposals: ATOM Tokenomics Research

The next phase of ATOM’s evolution is officially underway. Starting soon, the Cosmos community will begin the formal research process to design a new, data-driven tokenomics model for ATOM.

As previously discussed, the goal is simple: build a sustainable, long-term utility proposition for ATOM that reflects its central role in the Cosmos ecosystem and positions the Hub for growth in the enterprise era.

TL;DR

-

This research process will focus on building a fundamental, revenue-based tokenomics model for ATOM, rather than jumping straight into individual mechanisms or flywheel ideas.

-

The initiative follows a five-step process: Request for Proposals → Research Team Selection → Information Gathering → Research Results & Analysis → Governance.

-

Core research goals include understanding ATOM’s current dynamics, simulating alternative models, identifying sustainable demand and supply drivers, and designing a long-term transition plan.

-

Early community discussions surfaced many mechanism ideas, but also made clear the need to separate fundamentals from add-on mechanisms and to define the research scope more clearly.

-

The end goal is a sustainable, non-circular tokenomics model powered by real fees and ecosystem adoption, enabling resilient growth for the Cosmos Hub and future mechanisms built on top.

This post lays out the framework for how the research process will unfold, including a rough timeline and the five major stages of work, as well as how people can get involved at each stage. Timelines may shift. This is an iterative process, not a rigid schedule, but the structure is designed to ensure transparency and continuous community involvement from start to finish.

Research Goals

Before diving into logistics, it’s worth restating what this research is meant to achieve. The objectives of the research, first outlined in October, remain unchanged:

-

Learn as much as possible about ATOM, its market dynamics, usage, and behavior today through comprehensive research.

-

Test and simulate how different tokenomics models would perform under various Hub and ATOM use-cases.

-

Chart a risk-minimized, sustainable transition plan from the current tokenomics mechanism.

-

Design and launch a new tokenomics model that gives the Hub and ATOM multiple ways to grow its utility across the ecosystem.

- Notably, this includes synthesizing new and existing demand drivers for ATOM with supply-side changes to create a powerful economic flywheel.

These goals guide every step of the process described below.

The Five-Step Process

The research initiative will unfold in five distinct steps:

-

Request for Proposals

-

Research Team Selection

-

Information Gathering

-

Research Results & Analysis

-

Governance

Each phase has a defined purpose and will involve both Cosmos Labs and the broader community in meaningful ways.

Step 0: Takeaways from Initial Community Discussions

The community has shared that they are eager to contribute to the tokenomics discussion, so we opened up a public working group on telegram to act as a town square to host these discussions. The results showed just how passionate the Cosmos community continues to be, with thousands of messages sent in the group over the span of just a few days, and many incredible ideas surfaced. Some of these ideas include:

-

Rewarding long-term stakers more by gradually increasing staking rewards over time to favor long-term holders.

-

Lowering Inflation, either all at once or via a phased and replacement approach

-

Unifying the ecosystem under ATOM as the reserve, gas, and settlement asset

-

Variable inflation model depending on fee accrual

-

And many more!

One recurring message we kept seeing in the course of those discussions was there was a desire for the research to move faster and requests for Cosmos Labs to take more ownership over the scope of the research. Message received.

As a result of this process, we’re better defining exactly what’s in scope for the research. There were many interesting mechanisms discussed as part of the initial discussions, but it’s important to distinguish between those mechanisms and the fundamental tokenomics model upon which all future mechanisms will be built.

Osmosis Tokenomics Example - Fundamentals versus Mechanisms

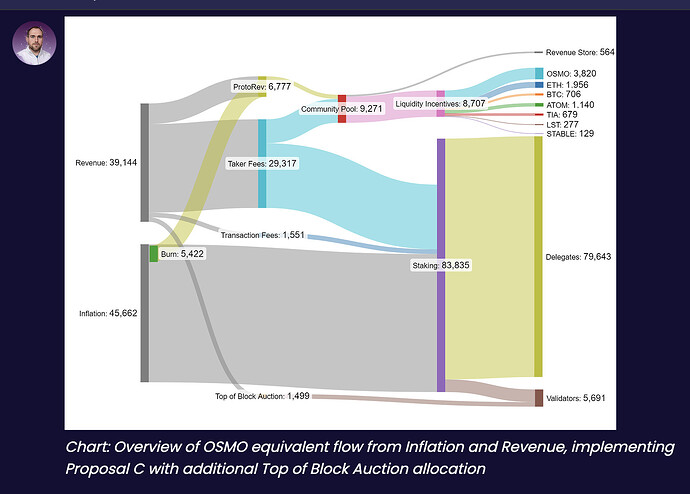

As an example of the difference between tokenomics fundamentals and associated mechanisms, look at the Osmosis tokenomics. Fundamentally, Osmosis creates value for the OSMO token by capturing fees from various sources within the Osmosis protocol. Over the years, numerous mechanisms have been developed on top of that revenue model, such as driving a portion of fees toward OSMO stakers, buying back and burning the token, and other methods of gradually replacing inflation with fees.

Similarly, we need to adjust the fundamental tokenomics model of ATOM before it makes sense to build individual flywheel mechanisms aimed at driving ATOM usage. It’s important to segment the conversation and the research accordingly.

In addition, any changes to the fundamental model need to be accepted by the community via governance before it makes sense to add flywheels. The upcoming tokenomics RFP will be targeted at building that fundamental model.

As with the Osmosis example, the fundamental tokenomics model for ATOM should be revenue/fee based. In this case, however, fees could accrue from things such as the enterprise adoption and usage of the Cosmos Stack and/or associated services, apps or products.

This is similar to the recent tokenomics announcements updates by zkSync and Uniswap with their revenue-based tokenomics models. ATOM can get ahead of the game by adopting this type of model.These models are strong because they favor flexibility and diversity, with the ability to build out multiple additional tokenomics mechanisms on top of them.

Importantly, this type of model is also non-circular. Many tokenomics models today are circular, relying on purely internal inputs to drive scarcity or artificial token growth. As an example, veTokenomics models for dexes rely on forced token lockups to keep supply scarce in order to offset the sell-side pressures of token emissions. The main issue with circular models such as this is that once the token price begins to decrease, the entire circular economy collapses in upon itself, creating an inverted flywheel (see Curve).

With real sustainable revenues from enterprise adoption of the Cosmos stack and/or other mechanisms, we don’t need to design these circular tokenomics systems for ATOM anymore. Rather, we can build a model that adapts supply-side dynamics to revenue growth in order to drive sustainable, real growth for ATOM. This model will survive regardless of short-term ATOM volatility so long as the fees continue to exist and accrue. The RFP will set a revenue-based constraint for the research to focus on. In the meantime, other ideas may be presented in the forum in a separate section.

Step 1: Request for Proposals [Current stage]

Starting soon, Cosmos Labs will release the Tokenomics RFP on the Cosmos Hub forum for public review and feedback.

In parallel, the RFP will be circulated to a number of respected research firms with deep experience in blockchain economics and protocol design, though anyone is welcome to submit a proposal of their own.

To ensure fairness, proposals will first be submitted privately to Cosmos Labs before being republished publicly on the Hub forums for open feedback. This prevents undercutting of bids while maintaining transparency once the bid process is complete.

Firms will have roughly three weeks to submit their proposals.

How to Get Involved:

-

Validators: We’ll be hosting our first validator ecosystem call on this and other topics in December. Join the Cosmos Hub Validator telegram group if you haven’t already for the announcement (Validators, DM me on telegram @RoboMcGobo if you’re interested).

-

Community: Keep an eye out for the RFP on the Cosmos Hub forums and prepare to give your feedback there.

Step 2: Research Team Selection

Once submissions close, we’ll organize public feedback sessions where the community can discuss the proposals, and participating firms will have the opportunity to present their ideas live.

After the review process, Cosmos Labs will select two to four firms to conduct the research based on familiarity with the Cosmos ecosystem, demonstrated success in tokenomics design, and overall cost and quality of approach. Selecting multiple firms ensures diverse methodologies and perspectives, a key ingredient for robust modeling and resilient design. Community feedback will be part of the review process in firm selection.

How to Get Involved: Read each proposal and provide feedback in the relevant sections of the forum. We’ll communicate any public calls in advance to give the community an opportunity to ask pointed questions.

Step 3: Information Gathering

With research teams in place, the process moves into the data-collection phase. Over several weeks, the selected research firms will:

-

Dive deeply into Cosmos Hub’s current tokenomics, emission schedules, and existing demand drivers.

-

Conduct stakeholder interviews with ATOM holders, validators, developers, and ecosystem partners.

-

Map how different stakeholder groups interact with and depend on ATOM today.

-

Simulate some of the different approaches suggested by, and ideas gathered from, the community.

The goal is to understand not only how the system works in theory but how it functions in practice, as well as its impact on the various Hub / ATOM stakeholders. Armed with that understanding, the research teams will begin building out economic models and sharing preliminary findings publicly as their work progresses.

How to Get Involved: This will be the most critical component of the community’s involvement. We will organize public and private (solo and group) interview sessions between the researchers and validators / the community. We want to solicit a broad sample size of stakeholders to give the researchers as much context as possible on ATOM, the Hub, and the ecosystem.

More details on specific feedback groups will be posted in the forum and on socials as we get more details.

Step 4: Research Results & Analysis

Each research firm will produce a draft report outlining its proposed model and findings. These drafts will be released for community review and feedback.

As feedback is collected, the reports may be revised to address errors, assumptions, or nonviable components. Once all reports are finalized, Cosmos Labs and the community will work together to synthesize the strongest elements of each into a single, unified tokenomics framework.

This composite model will then be refined into a governance proposal (or series of proposals) for formal review on the Hub.

How to get involved: Give your feedback on each research report, and help us identify which components of the various reports may be valuable to add to others.

Step 5: Governance

By the time the proposal reaches the governance stage, the community will already be familiar with its content. The proposal will undergo one final round of public discussion on the Cosmos Hub forum. After any final edits or clarifications, the proposal (or series of proposals) will be submitted for an on-chain vote.

If passed, Cosmos Labs will begin enshrining the new tokenomics mechanism in code, marking the formal start of ATOM’s next chapter.

How to get involved: Vote! This has the potential to be one of the most important governance proposals in Cosmos history. It will be all the more impactful if the entire community shows up to make their voices heard.

The Road Ahead

The launch of the tokenomics research process is a chance to align the Cosmos community around a shared vision for how ATOM can evolve over the years ahead. Over the coming months, expect active discussion, public updates, and frequent collaboration between research teams, Cosmos Labs, and the wider community.

If you want to participate, start by joining the Cosmos Hub forums where all discussions, drafts, and updates will be posted.

The process begins soon. Let’s make it count.

Disclaimer

Cosmos Labs has been engaged by the Interchain Foundation (ICF) to conduct research on, and an assessment of, how best to support the health and long-term sustainability of the Cosmos Hub and the wider ATOM ecosystem. This work is focused solely on analysis, research, and community-oriented recommendations. Nothing in this process should be interpreted as financial advice, an effort to influence the market for ATOM, or any intention to manage, promote, or affect the price, value, or trading behavior of ATOM. This work does not treat ATOM as a security, nor should any part of it be understood as implying future value, returns, or investment expectations. The views and proposals developed through this engagement are for the benefit of the ecosystem and do not create obligations or responsibilities for either Cosmos Labs or the ICF.