TL;DR - As a follow-up to the Monetary Policy post laid out here, Blockworks Research is looking for community feedback on their recommendation of changing ATOM’s fiscal policy from a static 10% community pool tax to a multi-pronged tax approach. This is Part 1 where we introduce the idea of a dynamic liquid staking tax and a proposal to remove the 25% liquid stake cap imposed by the LSM, with another follow-up post related to additional tax ideas coming early next week.

Blockworks Research is also looking for feedback on the initial parameters mentioned in this post, with the understanding that the community will ultimately decide the final parameters.

Fiscal Policy (Current State)

Historically, the Cosmos Hub had a very simple fiscal policy where X% of ATOM inflation went to stakers and the remainder went to the Community Pool to be used for ad-hoc spend proposals. Prior to the rejection of ATOM 2.0 with Prop 82, 98% of inflation went to ATOM stakers and 2% went to the community pool. This left the Hub heavily underfunded to align developer teams, fund public goods and initiatives that could bring value back to the Cosmos Hub, and potentially leverage Protocol-Owned-Liquidity to align ATOM with the growth of the Interchain.

Although Prop 82 was rejected, it opened up much-needed dialogue on what the future of the Cosmos Hub should be and, at the very least, showed the glaring need to right size the community pool to fund initiatives that bring utility to the Cosmos Hub. With Prop 88, Simply Staking proposed to raise the community pool tax from 2% to 10%, effectively funding the pool with ~400k ATOM/mo at current inflation levels.

Below is an outline of the Cosmos Hub’s current budget distribution.

Due to Prop 88, the community has been able to fund initiatives like the ATOM Accelerator (AADAO), fund core teams like Notional to perform critical auditing work for the Cosmos Hub, and provide Protocol-Owned-Liquidity to Stride and Neutron to help bootstrap the AEZ’s onchain economy. While we are not here to argue the merits of these particular spend proposals since there will always be those “for” or “against” these types of initiatives, the point we want to drive home is that the community now has the ability to fund what it wants once social consensus is reached. Prior to Prop 88, the Cosmos Hub would have been hamstrung by the size of its community pool even if there was consensus on a given initiative.

But this current state of how the Cosmos Hub budgets its inflation and ICS revenue still leaves alot to be desired.

Should all spend proposals be done Ad-Hoc where the community has ~1 month to discuss via forums prior to be put to vote? Is the community pool tax, which everyone must bear, the best way to fund the community pool going forward? Should there only be one bucket that all tax revenue funnels to (like a slush fund)?

We are here to build the future of Onchain Institutions. Institutions that are transparent, accountable, and most importantly, strategic and effective. To do this, not only do we need to reform our governance processes to make them more agile, but we must also take best practices from corporations that reduce waste and introduce more accountability by properly budgeting strategic initiatives well in advance of their typical fiscal year. This will likely require, at the very least, yearly budget reviews for the community to decide parameters that dictate what percent of inflation and revenue go towards core development (future post from Binary coming soon on this), subDAOs where SMEs have term limits focused on specific verticals that could drive ROI for the Cosmos Hub (future post from RMIT on this subject), and Protocol-Owned-Liquidity to reinforce ATOM’s monetary characteristics and align the Cosmos Hub with the growth of the AEZ and wider Interchain via something like the ATOM Alignment Treasury proposed by Binary here.

Whats important to emphasize is that the community should ALWAYS have the ability to veto funding requests, pull funds from ongoing initiatives, or remove a service provider (core development team or subDAO member) and bring it back to the community pool in the event they feel they are not being properly served. This is non-negotiable in Blockworks Research’s opinion.

Ultimately, the combination of onchain governance with shared security service provision allows the Cosmos Hub to not only create better human coordination mechanisms internally, but externally as well with its consumer chains. The ATOM Economic Zone is the first multilateral network where chains are not only aligning with the Hub, but the Hub is aligning with those chains as well. We believe the intention behind these security and economic alignments have the potential to create more efficient and value accretive onchain economies in the long run and the Cosmos Hub should lean into this superpower moving forward.

While this post will not be diving into future governance structures of the Cosmos Hub, we felt it was important to outline our high-level thoughts before elaborating on our fiscal policy recommendations.

Introducing a Dynamic Liquid Staking Tax

We believe the introduction of the Liquid Staking Module is a monumental moment for the Cosmos Hub. As we elaborated on in our Monetary Policy post, the advent of liquid staking allows stakers to both secure PoS networks AND participate in DeFi activities. In doing so, PoS networks no longer need to compete with DeFi yields to maintain its security.

But liquid staking is not a silver bullet solution and comes with it its own set of problems.

Due to network and liquidity effects, liquid staking is likely a winner-take-alll market structure, which can cause centralization and security concerns due to intentional or unintentional activity by the dominant LST provider. To read more about the risks of liquid staking, we recommend reading this piece authored by @dannyryan on Twitter/X.

Because Ethereum attempts to be “credibly neutral” and has no enshrined mechanisms in place to limit LST protocols or create disincentive mechanisms around liquid staking, it has succumbed to these centralizing market forces as Lido, the dominant LST provider today, approaches the critical consensus threshold of 33%.

Luckily, the Cosmos developer community foresaw these concerns early on with the introduction of the Liquid Staking Module that was recently implemented on the Cosmos Hub with the v12 upgrade (shout out @zaki_iqlusion, the Iqlusion team, and all LST provider teams that brought that to the finish line). After all, liquid staking was essentially invented in the Cosmos by the GodFather of Liquid Staking, @FelixLts.

The liquid staking module allows the Cosmos Hub to be cognizant of how much of its staked supply is liquid staked and imposes a global cap of 25% LST market penetration.

The LSM unlocks ~$500M of staked ATOM capital to potentially be used in Cosmos DeFi. This not only provides much-needed liquidity in an ecosystem that has historically lacked liquidity, it also reinforces ATOM’s “moneyness” by allowing stATOM to become the predominant form of collateral in DeFi, the main base pair on DEXs, and a main gas token on the largest chains in the Interchain. The LSM doesn’t force Cosmonauts to choose between staking OR participating in DeFi - they can now do both!

Lets go back to the diagram that references the Cosmos Hub’s budget distribution and update it to include the LSM.

But is an artificial cap on liquid staking the final state?

What happens if the cap is reached and more people want to liquid stake? Should those that were the first to liquid stake, mostly the more sophisticated market participants, be the only ones that benefit?

Additionally, the LSM only limits onchain LST providers like Stride, Persistence, and Quicksilver. It does not limit offchain LST providers like CEXs, putting onchain providers at a structural disadvantage and potentially compounding the centralization risks LSTs have.

Would the Cosmos Hub community rather have Coinbase/Kraken be the dominant LST provider or a consumer chain like Stride that has intentionally decided to align with the Cosmos Hub as an economic partner?

While the 25% global cap is a governance-controlled parameter that can be changed in the future, we believe 80-100% liquid staking market penetration is inevitable on a long enough time horizon, either at the will of the community or by natural market forces where users choose to leverage offchain providers.

As an attempt to solve this issue, we are proposing to remove the LSM 25% cap and instead implement a dynamic liquid staking tax.

Liquid Staking Providers are effectively borrowing/lending protocols. Users lend out their native assets to the LST provider, and in return, borrow a pegged asset at a flat borrow rate (the provider’s take rate).

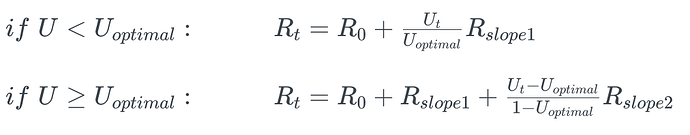

With this mental model for LSTs in mind, we looked at lending protocols like Aave that use an interest rate model as seen below to profit off of the demand for a given asset AND disincentivize too much demand for an asset that puts its LPs at risk:

In simple terms, the interest rate that someone pays to borrow an asset is a function of how much of that asset is being borrowed against how much is supplied to be lent out (“Utilization Rate”). With this model, there are four governance-defined parameters:

- Base Rate (R0)

- Interest Rate Slope 1 (R1)

- Interest Rate Slope 2 (R2)

- Optimal Utilization Rate (Uoptimal)

When the market Utilization Rate (Ut) of a given asset passes Uoptimal, the interest rate climbs at the steeper slope (R2).

Below is a simple visual of this interest rate model.

Blockworks Research proposes this model as a “v1” for the dynamic liquid staking tax.

This model would be a flat tax on all liquid stakers that would get steeper as the demand for liquid staking grows. This allows the market to find a natural equilibrium for liquid staking market penetration through disincentive mechanisms while also allowing the Cosmos Hub to generate meaningful tax revenue from the demand for liquid staking.

We consider this a “v1” of the dynamic liquid staking tax because there are theoretically multiple ways to implement this tax as the liquid staking market matures:

- Implementing a flat tax on all liquid stakers equally (v1 - recommended)

- Implementing a tax based on the market dominance of a given LST provider (not recommended today)

- Example: Stride LSTs would face a larger tax than Quicksilver since Stride has a larger market share of LSTs today

- Validator-specific LST tax (not recommended today)

- The LSM could theoretically impose a tax at the validator level based on how many tokenized shares are held by that validator

To quantify how much revenue this can generate for the Hub, we use the following governance-controlled parameters:

- Base Tax (R0) - 5%

- Tax Slope 1 (R1) - 5%

- Tax Slope 2 (R2) - 90%

- Optimal Utilization Rate (UOptimal) - 33%

We’d also recommend adding a fifth governance-controlled parameter called the “0% tax Utilization threshold” (U0%). To encourage the growth of liquid staking early on, the first X% of liquid staking utilization should not see this tax. For this exercise, we propose U0% of 25%, meaning once 26% of all staked ATOM is liquid staked the tax kicks in on all liquid stakers.

Below is how much cumulative revenue the Cosmos Hub can generate (in ATOMs) by the end of the decade at different levels of liquid staking market penetration using the inflation schedule proposed in our Monetary Policy post (assuming the stated market penetration happened on day 1 of this tax being introduced):

This tax creates a yield spread between liquid stakers and non-liquid stakers. We consider this the “Liquid Staking Opportunity Cost”. Since the major reason to liquid stake is to generate additional yield via DeFi activities, this is the yield the average rational actor should hope to generate in DeFi to accept this additional liquid staking tax (note: this yield spread also includes the 10% take rate of Stride, as an example).

For example: if the proposed inflation schedule and LST tax parameters mentioned above were put in place, in August 2025 at 50% LST market penetration (aka the percent of staked ATOM that is liquid staked), the average liquid staker would have to generate ~2.2% yield in DeFi to make liquid staking a +EV opportunity.

Because the proposed inflation schedule lowers inflation over time, the yield spread between native and liquid stakers naturally compresses.

There are multiple ways to spend this tax revenue:

- Burn the tax revenue

- Fund the ATOM Alignment Treasury as POL

- Funds core development or subDAOs

- Distribute it to native (non-liquid) stakers

While the community will ultimately decide if it wants to pass this tax and what to do with it, we believe the right thing is to either burn the tax (1) or a mix of (2) and (3).

Burning the Tax Revenue (LSM-1559)

With EIP-1559, Ethereum’s supply is a function of its onchain economy (more activity = more burn). Without smart contract capability, we believe the demand for liquid staked ATOM is a close proxy for the growth of the wider Interchain economy. This creates an interesting dynamic where the Cosmos Hub’s fiscal policy can influence the monetary policy by lowering inflation further. While we did not propose a hard max cap for ATOM in our Monetary Policy post, burning the liquid staking tax could effectively put an artificial cap on ATOM’s supply if there was sustained demand for LST ATOM at 100% market penetration.

Fund the AAT or Core Development/SubDAOs

A liquid staking tax can be seen like a speculation tax akin to what states do in the US with a Lottery system. States use their significant lottery revenues to fund public infrastructure and reduce other tax burdens on the wider population. We believe the liquid staking tax could be a great source of revenue to fund core development or generate more POL for the Cosmos Hub, which can drive greater economic activity of the AEZ (and more revenue for the Cosmos Hub).

Although not a prerequisite for the dynamic LST tax, Blockworks Research also recommends Stride and other LST providers work on a dual governance structure whereby stATOM holders (or even the Cosmos Hub itself) has veto power over any governance proposals that potentially harm the sovereignty or security properties of the Cosmos Hub. Lido has done good research on a dual governance approach where stETH holders will have governance power in Lido to better align the LST provider with the protocol. You can read more about what Lido has been researching here.

Follow-Up Posts

Blockworks Research will follow this up with another post early next week where we highlight additional tax ideas that we believe could not only help bolster the Cosmos Hub community pool further but also may help with validator centralization risks and economics around Replicated Security.

Again, thank you for taking the time to read this, and we look forward to your feedback! ![]()