There’s a lot of controversy around the recent proposal, but I think everyone can agree that high inflation rates are bad for long term growth & sustainability.

Some argue that the 20% staking reward is too high & scares of serious investors, while others argue it’s better for network security by attracting delegators interested in passive income. In both scenarios high inflation rates are a problem.

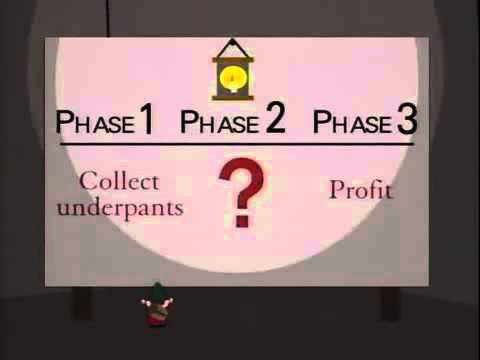

Potential solution: Maybe I’m being naive, but it seems like a less controversial solution would be to implement a burn mechanism to transaction fees…

This would be the best of both worlds as we could maintain attractive staking rewards around 20% while minimizing inflation and potentially becoming deflationary depending on the burn rate & network growth.

Why aren’t more people discussing or better yet, pursuing this as a possibility?

There’s already a proposal to increase transaction fees, which will help minimize & potentially eliminate the impact a fee burn mechanism would have on a validators bottom line. I’d love to see someone throw up a proposal to introduce a fee burn mechanism.

The only issue that needs to be resolved is a numbers game… What % of fees should be burned & how much should fees increase to prevent validators from losing revenue?

It makes sense to me to increase fees by 50%, while adding a 25% burn mechanism. In this scenario, validators will actually pull in a net gain and investors/delegators will benefit from lower inflation rates.

Example:

Old fee = 10, Validators earn 10

New fee = 15 + 25% burn = (-3.75), Validators earn 11.25

Those #’s are just me spitballing, but I’m sure it’s possible to analyze on chain data to find the percentages that create the most impactful & mutually beneficial solution… I’ll let people with better technological & economic backgrounds figure that out.

Does this make sense?

- If so, can someone create or help me create a governance proposal?

- If not, can someone explain what I’m missing & why it wouldn’t work?

Any & all support & insight is greatly appreciated. ![]()