Change log

- 2023-09-07 Created initial post

- 2023-09-08 Removed section regarding POL; Add 6-second block time

- 2023-09-14 Added Last call date

- 2023-09-14 Removed Last Call to allow a longer discussion period

Summary

IBC. Everywhere.

Our vision is for the Composable ecosystem to become a transaction-processing locale for chain-agnostic transactions. To facilitate such transactions, we are deploying new features and connections on our Cosmos SDK Chain.

Thus, we present a signaling proposal for the Composable chain to become a member of the ATOM Economic Zone (AEZ) and integrate Interchain Security (ICS) from the Cosmos Hub. Resultantly, the Composable chain would share the Cosmos Hub’s economic security. In return, Composable would share revenue. If this proposal passes, Composable will share 20% of IBC Bridging fees across all ecosystems Composable connects to with the Cosmos Hub. We will also allocate 20% of inflationary staking rewards to the Hub. Additionally, Cosmos Hub validators will be able to operate relayer side cars in our ecosystem. Relayers will be able to capture MEV by sending order flow to order flow auctions like MEV-share.

If this proposal is ratified, additional benefits would be delivered to not only Composable’s ecosystem and users, but also to the Cosmos ecosystem and its validators, chains, users, token holders, and AEZ, as expounded upon below.

Composable’s vision for its consumer chain is:

- Expanding IBC

- Extending security and settlement

- IBC as a mechanism for orderflow processing

Expanding IBC

Composable’s Cosmos SDK chain is at the core of our extension of the IBC protocol for trust-minimized cross-chain communication. The IBC protocol previously was limited to trust-minimized bridging and message passing between Cosmos SDK chains. We are the first to extend IBC to other ecosystems, with the Composable IBC connection between Polkadot and Cosmos going live on June 29, 2023. At present, Composable’s bridge connects Polkadot, Kusama, Cosmos, and Ethereum (the lattermost of which is in testnet). Moreover, we are dedicated to building more IBC solutions and exploring many other ecosystems.

Bringing IBC Routing Back to the Cosmos Hub

The Cosmos Hub has long envisioned bringing IBC routing back to the Hub. If this proposal is implemented, given that the Composable chain is the hub for connecting to other ecosystems, as a consumer chain of the Hub, the Hub becomes a router for IBC assets.

Exporting Atom Liquidity to Other Ecosystems

Via IBC expansion, ATOM will flow to Ethereum, Solana, the modular ecosystem, and more, resulting in increased ATOM users through new use cases including those in Ethereum. Additionally, using infrastructure built on Neutron and Ethereum, the Hub would be able to enter into agreements with other protocols. This will directly benefit Interchain protocols, as they can leverage this new reach of ATOM and can draw in new users from other ecosystems that have purchased ATOM to participate in this opportunity.

This is exemplified below with a comparison via Matic’s L2 launch (Jun '20) and the swift increase in unique Ethereum addresses that followed:

In addition, via our relayer liquidity module, users can pay IBC gas fees in ATOM.

Extending Security and Settlement

A Restaked Layer on the Cosmos Hub

Composable is creating a restaked validator layer on our chain to provide security for multiple use cases in the form of a Restaking Module deployed on Composable. Here, users and validators stake IBC-enabled liquid staking tokens (stKSM, stDOT, and stATOM). Staking use cases are endless, but the most exciting are:

- Bootstrapping additional Cosmos chains, potentially using the alliance module

- Proposer/builder/searcher commitments (more on this below)

- Supporting bridging on chains that do not have state proofs through an emulated layer

EigenLayer Security

Change to Composable seeks to also gain security from EigenLayer (EL), an Ethereum protocol for restaking. On EL, ETH stakers restake their ETH or liquid staking token to extend the crypto-economic security from their initial staking to additional applications. Composable intends to register as an AVS, and pass slashing parameters over to EL over IBC.

Additionally, Composable intends to extend EL security to other Cosmos chains. Using the same restaking module previously mentioned, we will have a middleware registry component that allows various operators to register for EL security. They then would interact with us as the operator, and then we would pass these messages to EL contracts over IBC.

Thus, Composable can enable the use of security of both ecosystems (Ethereum and Cosmos). Projects registered as middleware, if they misbehaved, could be slashed in both locations. Both would be orchestrated by Composable.

Path to Launch

We will open restaking with the launch of stATOM as a restaked asset. Then, we will onboard various middleware operators and focus on partial block auctions, our emulated light client layer, optimistic bridging, etc. EL security will then be enabled whenever EL launches this feature.

Rollup Settlement

We can also explore enabling rollups to settle on the Cosmos Hub, which would be cheaper than settling on Ethereum. For this purpose, the state is sent to Composable’s chain and the Cosmos Hub for validation. This involves rollups on top of the EigenDA (or any DA):

IBC as a Mechanism for Orderflow Routing

One issue associated with user expression of problems/solutions is lack of a generalizable language for execution. We built the Composable Virtual Machine (VM) to interface with any execution framework, with messages routed over IBC. Users can submit their transaction intentions from any chain which interfaces with MANTIS (Multichain Agnostic Normalized Trust-minimized Intent Settlement). Solvers then generate a solution to fulfill these transactions, and are incentivized to do so. This process also involves decentralized block building for multiple domains, specifically focused on top-of-block (TOB) auctions.

Through this mechanism, Composable becomes a chain dedicated to orderflow processing and routing to different ecosystems.

Proposal

Ask from the Hub

Composable is asking to join the AEZ and benefit from the Hub’s security.

Cosmos Hub Validator/Staker Incentives

Bridging Fees

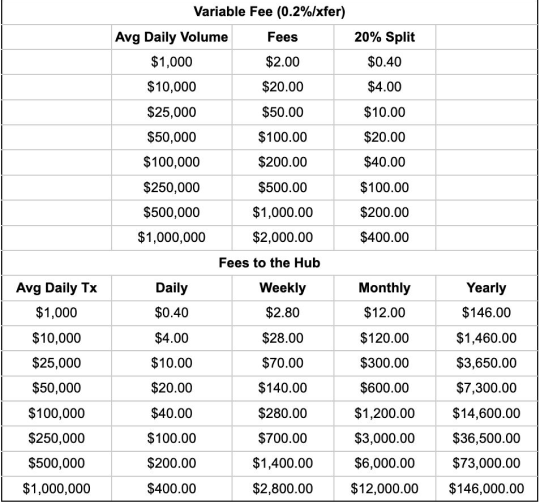

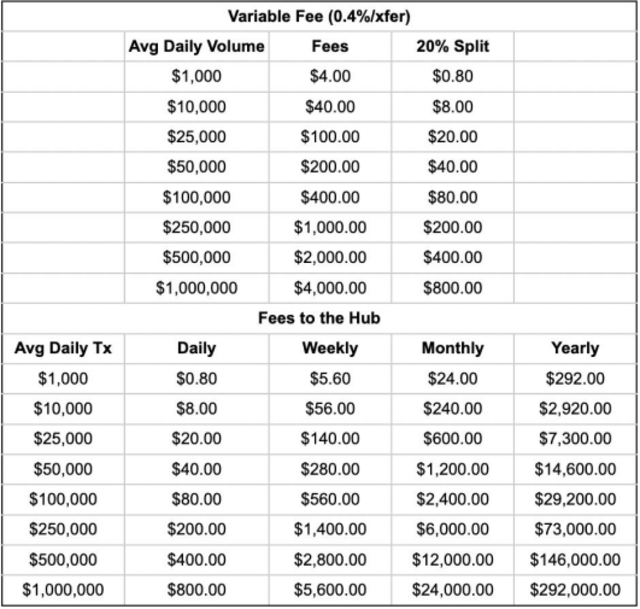

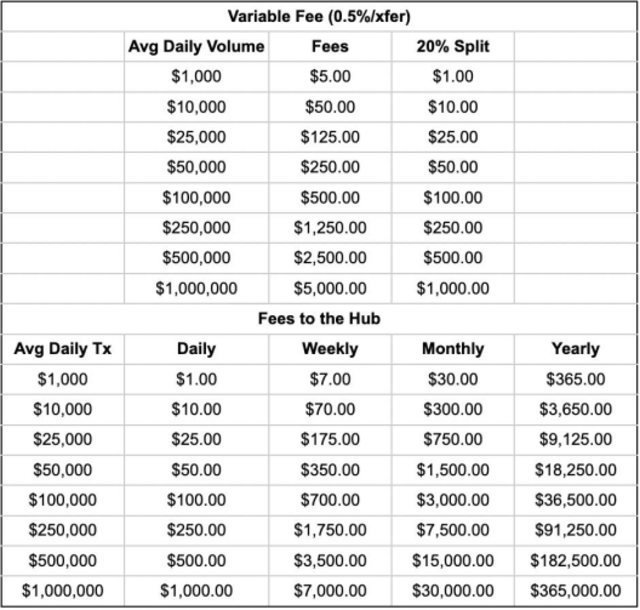

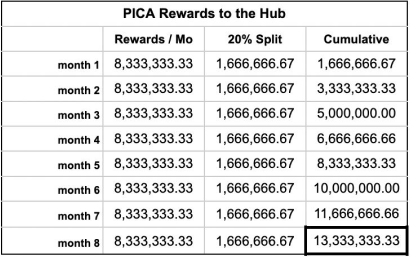

As Composable continues to expand its IBC connections, it is important for there to be a fee paid in notional amounts for cross-ecosystem IBC. If this proposal passes, Composable will share 20% of these IBC fees with the Cosmos Hub:

While Composable’s bridge and chain are relatively new, they are deployed and growing quickly. Revenues are predicted to continue to grow as well, particularly as new chains are connected. Moreover, if the present proposal is approved, it is likely that Composable’s revenue growth will accelerate, thanks to the benefits delivered by the ICS and AEZ.

Below are outlined possibilities of flat fee structures for transfers across Composable Chain:

Below are outlined possibilities of variable fee structures for transfers across Composable Chain:

Additionally, Cosmos Hub validators will be able to operate relayer side cars in our ecosystem. Relayers will be able to capture MEV by sending order flow to order flow auctions like MEV-share. Or, depending on the validity predicate encoded in a specific packet, they can send it back to the Composable chain where it can subsequently be passed to the Cosmos Hub. We are collaborating with the Ethereum Robust Incentives Group (RIG) to work on modeling this amount.

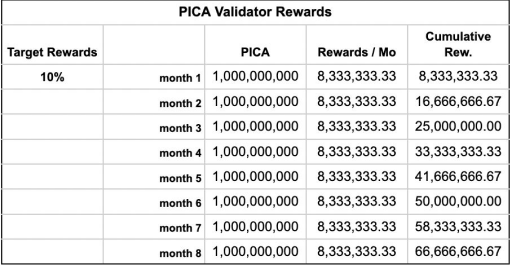

A Portion of Inflation Rewards

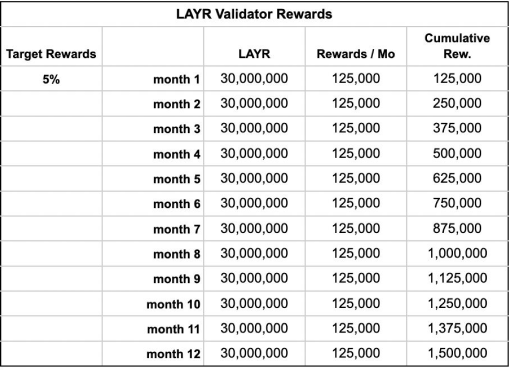

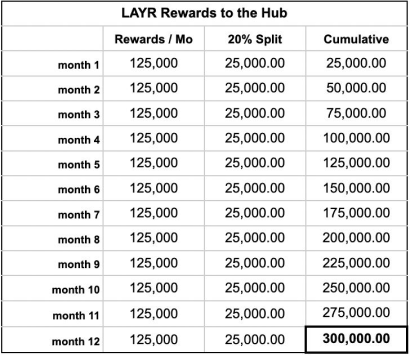

We will allocate 20% of PICA and LAYR staking rewards to the hub. See the tokeneconomics section below for details.

At the moment, Centauri Chain PICA validator rewards target a 10% APY based on the approx. 1B PICA staked to validators the chain. (note: 650m of the designated 1B are currently delegated to validators resulting in an increased reward rate of ~15.38%)

Similar to PICA rewards, LAYR rewards will target a 5% APY based on approx. 30m LAYR staked to validators securing the chain.

In return, Cosmos Hub would share its economic security with Composable

PICA and LAYR Tokenomics

The Composable ecosystem has two tokens: PICA (the native token of our Kusama parachain, Picasso, as well as our Cosmos SDK chain), and LAYR (the native token of our Polkadot parachain, Composable). PICA is live, with LAYR launching in the future; currently PICA is in production and being used to validate both the Picasso and Composable chains.

The PICA token is used for:

- Liquid staking (future product)

- Collator Staking on the Picasso parachain

- Staking for bridging revenue

- Governing the Composable chain

- Apollo oracle staking

LAYR token use cases include:

- Collator staking on the Composable parachain

- Solver collateral

- Intents

- Tips for searchers - paid out in LAYR

- Users % - paid out in LAYR

- Protocols bidding - paid out in LAYR

- Restaking fees

Composable Chain Transition to ICS

Similar to Stride, the transition will likely not create any difference for the average user of Composable. Composable’s chain currently has 100 validators, which would become “governors,” and retain their current PICA delegation - continuing to do their daily duties, but not validating transactions.

PICA delegators would be able to stake with a governor, resulting in PICA rewards/revenue share from bridging. PICA rewards would continue, but would be reduced subject to PICA governance to keep tokeneconomics sustainable.

Soft Opt-Out

Validators in the bottom 5% of vote power in the Cosmos Hub validator set could opt out from validating the Composable chain. This is roughly the bottom sixty-five validators.

Governance

To ensure this agreement is mutually beneficial to both the Cosmos Hub and Composable, we propose that this agreement be reviewed each year to determine if changes are necessary.

Vision

Composable is a staunch supporter of the Interchain. Our 35+ person team is dedicated to advancing interoperability in DeFi. For us, that means expanding the IBC everywhere. We are proud that we were the first team to enable IBC outside of Cosmos SDK chains. With this critical accomplishment achieved, we are continuing to advance interoperability driven by the Interchain. Given that the IBC is based on trust assumption of an honest majority validator set, it is paramount for us to seek the highest amount of security possible to be a hub for IBC traffic. Furthermore, having a particularly secure hub for cross-ecosystem IBC will also reduce fungibility issues - meaning, chains that want to utilize ETH only need to use ETH from the Composable chain, rather than there being hundreds of different directly bridged ETH.

With a more secure IBC hub, we believe there would be more IBC traffic and users both going into other ecosystems, and coming to Cosmos. The greatest value that can be provided to Cosmos now is liquidity, users of ATOM, and DeFi + NFT use cases. A cross-ecosystem hub to facilitate all of these would drive immense value towards the ATOM token and its holders.

Thus, Composable fulfills the Cosmos Hub’s original vision of becoming the hub for cross-ecosystem IBC.

Hub Requirements

-

Link to binary : Release v4.5.1 · ComposableFi/picasso · GitHub

-

Link to genesis file : composable-networks/mainnet/genesis.json at main · notional-labs/composable-networks · GitHub

-

Genesis file details: composable-networks/mainnet at main · notional-labs/composable-networks · GitHub

-

Chain type and version (sdk, cosmwasm, hybrid) : sdk47 with ibc go v7

-

Default fee token : ppica

Repositories

Economic parameters:

-

Default fee token: PPICA. Bridged IBC ATOM will also be accepted.

-

Fee split between consumer and provider: 20% Hub / 80% Composable

Network parameters

-

Soft_opt_out_threshold: 0.05 (e.g. 5% of the voting power)

-

Commit_timeout: 1000ms (leads to ~2.5s blocktime on Pion-1)

-

Signed_blocks_window: 140,000 blocks (~4 days at 2.5s per block)

Software audit information

Ongoing involvement required from Hub validators (e.g., Governance structure, monitoring communication platforms, hardware requirements)

No required governance involvement.

Dedicated communications channels:

Discord: a dedicated channel: Discord has been created for Cosmos Hub validators.

Not required but recommended: Setup relayer between neutron and Cosmos Hub to relay voting power updates

Hardware requirements:

4 Cores

32 GB RAM

2x512 GB SSD

Useful Links/Socials

- IPFS

- Cosmos Hub Forum post and discussion

- Twitter space or community call recording

- Website

- Docs

- GitHub

- Discord

- Telegram

Governance votes

The following items summarize the voting options and what it means for this proposal:

- YES - You agree with the terms of the proposed security agreement and want this consumer chain to be secured by the entire Consmos Hub validator set using Replicated Security.

- NO - You do not agree with the terms of the proposed security agreement and/or do not want this consumer chain to be secured by the Cosmos Hub validator set using Replicated Security.

- NO WITH VETO - A ‘NoWithVeto’ vote indicates a proposal either (1) is deemed to be spam, i.e., irrelevant to Cosmos Hub, (2) disproportionately infringes on minority interests, or (3) violates or encourages violation of the rules of engagement as currently set out by Cosmos Hub governance. If the number of ‘NoWithVeto’ votes is greater than a third of total votes, the proposal is rejected and the deposits are burned.

- ABSTAIN - You wish to contribute to quorum but you formally decline to vote either for or against the proposal.